Understanding the 2025 Social Security COLA Increase

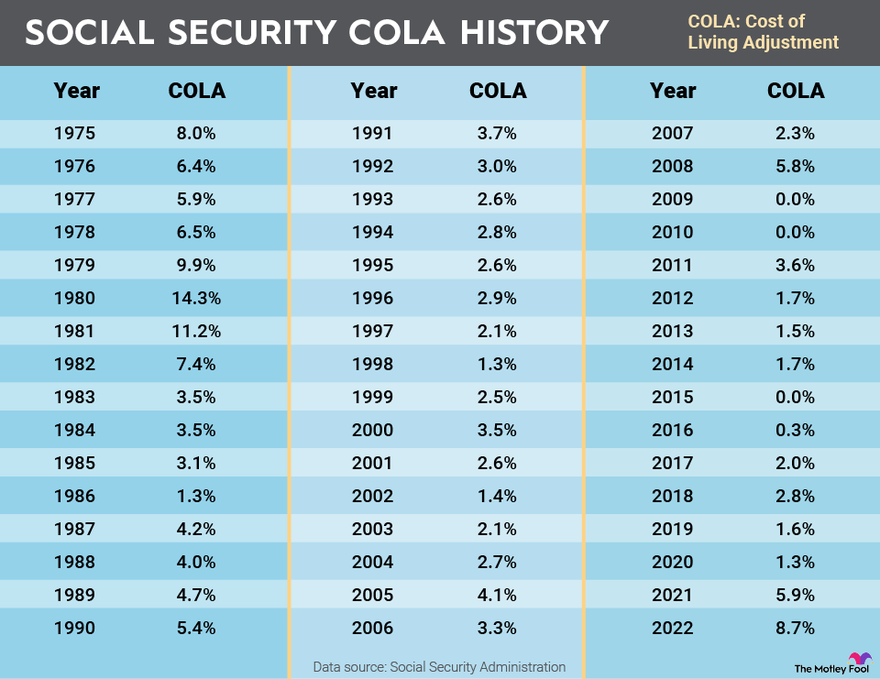

The 2025 Social Security Cost-of-Living Adjustment (COLA) is a crucial factor for millions of Americans who rely on Social Security benefits. The COLA increase aims to adjust benefits to account for inflation and ensure that recipients’ purchasing power remains consistent.

Factors Contributing to the COLA Increase Calculation

The Social Security Administration (SSA) uses a specific formula to calculate the annual COLA increase. The formula is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in the prices of goods and services commonly purchased by urban wage earners and clerical workers. The COLA increase is calculated as the percentage change in the CPI-W from the third quarter of the previous year to the third quarter of the current year.

2025 COLA Increase Percentage

The 2025 COLA increase is expected to be 3.7%, based on the CPI-W data released in September 2024. This means that Social Security benefits will increase by 3.7% in 2025, starting with January payments.

Impact of Inflation on the 2025 COLA Increase

Inflation plays a significant role in determining the COLA increase. If inflation is high, the COLA increase will likely be higher to compensate for the increased cost of living. However, if inflation is low, the COLA increase may be smaller. The 2025 COLA increase of 3.7% reflects the current inflation rate, which has been relatively high in recent years.

Impact of the COLA Increase on Beneficiaries

The 2025 Social Security COLA increase will directly affect the monthly benefits received by millions of Americans. This increase is designed to help beneficiaries maintain their purchasing power amidst rising inflation. However, the impact of the COLA increase will vary depending on the type of benefit received and individual circumstances.

Impact on Different Types of Social Security Recipients

The COLA increase will affect different types of Social Security recipients in different ways. For example, retired workers will see an increase in their monthly retirement benefits, while survivors will receive higher monthly survivor benefits. Similarly, individuals receiving disability benefits will experience an increase in their monthly payments.

- Retired Workers: The COLA increase will directly impact the monthly retirement benefits received by retired workers. The increase will be calculated as a percentage of the individual’s current benefit amount, ensuring that their purchasing power remains relatively stable.

- Survivors: Individuals receiving survivor benefits will also see an increase in their monthly payments. This increase will be calculated similarly to the increase for retired workers, ensuring that surviving spouses and children receive adequate support.

- Disability Beneficiaries: The COLA increase will also apply to individuals receiving disability benefits. This increase will help ensure that disabled individuals have access to the financial resources they need to meet their essential needs.

Financial Implications for Seniors and Other Beneficiaries

The 2025 COLA increase is expected to provide significant financial relief for seniors and other beneficiaries. The increased benefits will help them offset rising costs for essential goods and services, such as groceries, housing, and healthcare. For example, a senior couple receiving $3,000 per month in Social Security benefits could see an increase of $300 per month with a 10% COLA increase, providing them with additional financial flexibility.

Challenges Faced by Beneficiaries Despite the COLA Increase, 2025 social security cola increase

While the COLA increase is a welcome development, it is important to acknowledge that many beneficiaries continue to face significant financial challenges. The rising cost of healthcare, in particular, poses a significant burden for many seniors and individuals with disabilities.

“The cost of healthcare is a major concern for many Social Security beneficiaries, as it continues to rise faster than the rate of inflation. This can lead to difficult choices for seniors and individuals with disabilities, as they may have to choose between essential healthcare services and other necessities.”

- Rising Healthcare Costs: The cost of healthcare continues to rise at a faster rate than inflation, posing a significant financial burden for many beneficiaries. Seniors and individuals with disabilities often face high out-of-pocket costs for medications, medical treatments, and long-term care, which can significantly impact their financial stability.

Future Outlook for Social Security and COLA Increases

The future of Social Security is a topic of ongoing discussion and debate. The program faces challenges related to its long-term sustainability and the potential impact of factors such as demographics, economic conditions, and policy decisions. Understanding these factors is crucial for comprehending the potential trajectory of Social Security and its impact on beneficiaries.

Long-Term Sustainability of Social Security

The long-term sustainability of Social Security hinges on the program’s ability to generate sufficient revenue to meet its obligations to current and future beneficiaries. The program’s trust fund, which is funded by payroll taxes, is projected to be depleted by 2034. This depletion would not immediately lead to the program’s collapse, but it would necessitate significant adjustments to ensure its long-term solvency.

The Social Security Board of Trustees projects that the program’s trust fund will be depleted by 2034. After this point, the program would only be able to pay out about 77% of scheduled benefits.

There are several potential solutions to address the program’s long-term sustainability. These include increasing payroll taxes, raising the retirement age, reducing benefits, or a combination of these measures.

Factors Influencing Future COLA Increases

The annual cost-of-living adjustment (COLA) for Social Security benefits is designed to protect beneficiaries from inflation. However, the COLA is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which may not accurately reflect the spending patterns of retirees.

The COLA is based on the CPI-W, which measures the price changes of a basket of goods and services consumed by urban wage earners and clerical workers.

The CPI-W may not fully capture the spending patterns of retirees, who often spend a larger proportion of their income on healthcare and housing. This discrepancy could result in a COLA that is not sufficient to offset the actual cost of living for retirees.

Challenges and Opportunities for Social Security

Social Security faces a number of challenges in the coming years, including:

- Aging Population: The increasing life expectancy and the aging of the Baby Boomer generation are putting significant strain on the Social Security system. As more people live longer and receive benefits for a longer period, the program’s financial obligations increase.

- Economic Volatility: Economic downturns can lead to a decline in payroll tax revenue, which funds Social Security. The program’s reliance on payroll taxes makes it vulnerable to economic fluctuations.

- Rising Healthcare Costs: The increasing cost of healthcare is a major concern for retirees, as it can significantly impact their spending and erode the purchasing power of their Social Security benefits.

Despite these challenges, there are also opportunities for Social Security to adapt and improve its long-term sustainability. These include:

- Policy Reforms: Policy reforms, such as increasing payroll taxes, raising the retirement age, or reducing benefits, could help to ensure the program’s long-term solvency.

- Technological Advancements: Technological advancements, such as automation and artificial intelligence, could lead to increased productivity and economic growth, which could help to bolster Social Security’s financial position.

- Public Awareness: Raising public awareness about the importance of Social Security and its long-term sustainability is crucial for building support for necessary reforms.

2025 social security cola increase – While the 2025 Social Security cost-of-living adjustment (COLA) remains uncertain, beneficiaries might want to consider a table mate folding chair for maximizing their living space and budget. A portable workspace can help reduce the need for larger furniture, potentially freeing up funds for other necessities, even with a potential increase in benefits next year.

The Social Security Administration is expected to announce the cost-of-living adjustment (COLA) for 2025 in October, and beneficiaries are eagerly awaiting the news. The COLA is a percentage increase to Social Security benefits, designed to offset inflation. The projected increase for 2025 is substantial, and you can learn more about it and its potential impact on your benefits by visiting this informative article: 2025 social security cola increase.

With a significant increase expected, the COLA for 2025 could provide much-needed financial relief for many retirees and disabled individuals who rely on Social Security benefits.